The old saying is there's nothing certain in life but death and taxes. And unfortunately, as a private landlord, you're not exempt from either. But at least with taxes you more or less know what's coming. There’re rules you need to follow and tax regulations you must obey. In this article, we'll look at what goes into a landlord’s tax return and the new laws which will affect you.

Do I have to pay tax?

If you receive rental income from a property you have to pay tax. The exception to this is if your income is below £1,000 per year. Above that level, you have to declare your earnings and may be liable for income tax. We'll assume this is the case. We'll also assume you're paying tax as an individual. In other words, you haven't incorporated your business. If you're running a limited company there are different rules which apply.

What do I pay tax on?

You only pay income tax on the net profits from your property. Not on the gross rental income you receive. Also, remember to deduct your personal allowance before calculating your final liability. The final amount you pay depends on which tax bracket you're in. At the time of writing the basic rate of tax in the UK is 20% with a higher rate of taxpayers paying 40%. These rates may vary in Scotland.

How profit is calculated

The basic formula is: income minus allowable expenses equals profit. Your allowable expenses are any costs you incur while running your business. These could include:

Repair and maintenance costs.

Landlord insurance premiums.

Legal fees.

Accountancy fees.

Letting agent's fees.

Stationary.

Cleaning costs.

Mileage - but only for travel directly related to your property business.

Costs of replacing furniture etc. This replaces the wear and tear allowance which you can no longer claim for.

The above are all revenue expenses. These are different from capital expenses. An example of a capital expense is the cost of renovations. Those costs are offset against capital gains, not income tax.

Mortgage payments

Private landlords have taken several blows in recent years from the taxman. The biggest is the reduction in mortgage interest tax relief. Landlords will fondly recall the days of full relief. That changed in April 2017 resulting in higher tax bills for landlords with buy to let mortgages. By 2020 you won't be able to deduct any portion of your mortgage payments.

Other tax regulations

Stamp duty is another tax you face as a landlord. From April 2016 anyone purchasing a buy to let property has had to pay an extra 3% in stamp duty. For properties over £125.000, this rises to 5% and 8% over £250,000.

You'll also have to pay National Insurance contributions if your landlord business is your primary source of income.

Capital gains tax

If you sell a rental property for more than you paid for it, you'll have to pay capital gains tax. The tax laws surrounding capital gains are complex and lettings relief will stop in 2020. If you're selling a property it's always best to seek advice. An accountant or financial advisor will be able to advise you on the ins and outs of capitals gains tax.

Making tax digital (MTD)

MTD requires all landlords whose income is above the VAT threshold to keep records and submit their VAT returns using compatible software. The new regulations apply from the start of your next tax year after April 1, 2019.

Top five landlords tax tips

1. Don't think you can get away with not declaring or under-declaring your income. HMRC investigations are becoming more common. It's not worth the risk.

2. Don't be late in making your tax return. Missing the deadline will mean a penalty.

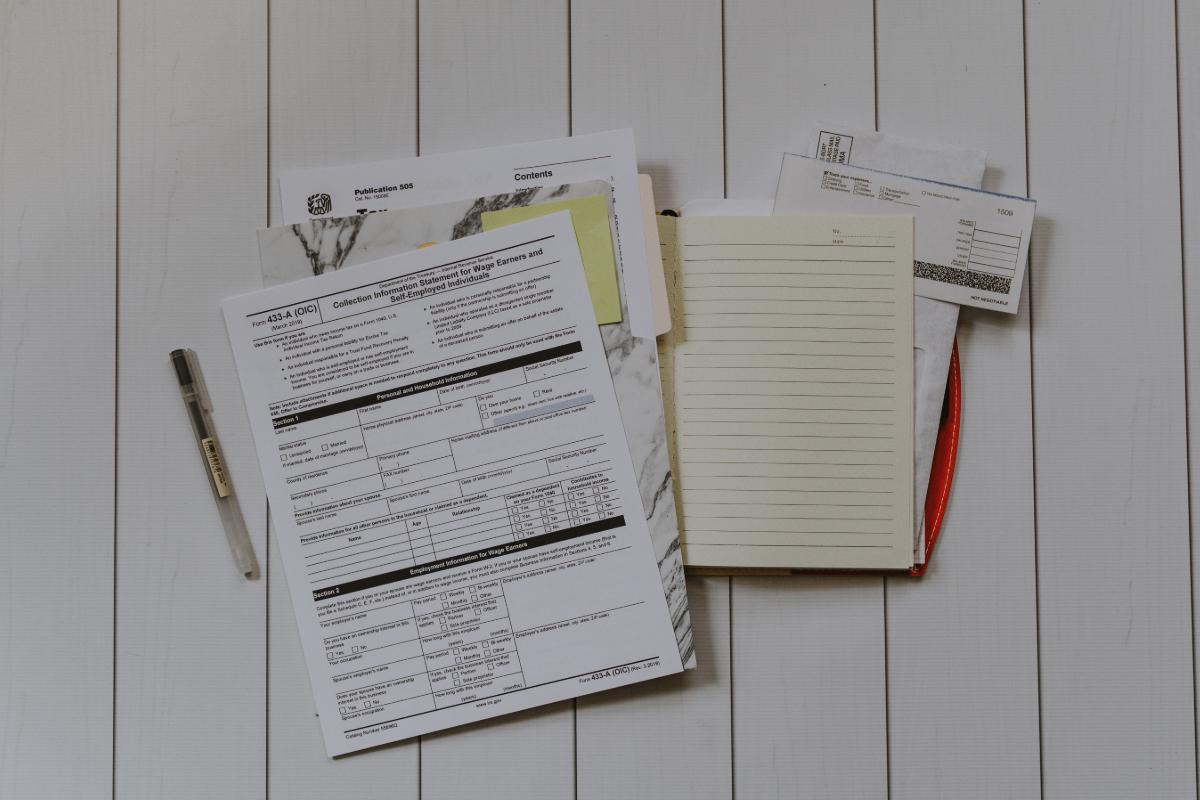

3. Keep all your receipts and records.

4. Claim for everything you're able to and reduce your tax liability.

5. Find a reliable accountant. Their fees are deductible and they will save you far more than they cost.

Point 5 above is very important. A good accountant is worth their weight in gold. They'll complete your tax return for you and will be able to take advantage of tax breaks you won't be aware of. Engaging the services of an accountant is highly recommended.

Private landlords can find tenants fast by listing their property with MakeUrMove the online letting platform bringing landlords and tenants together.